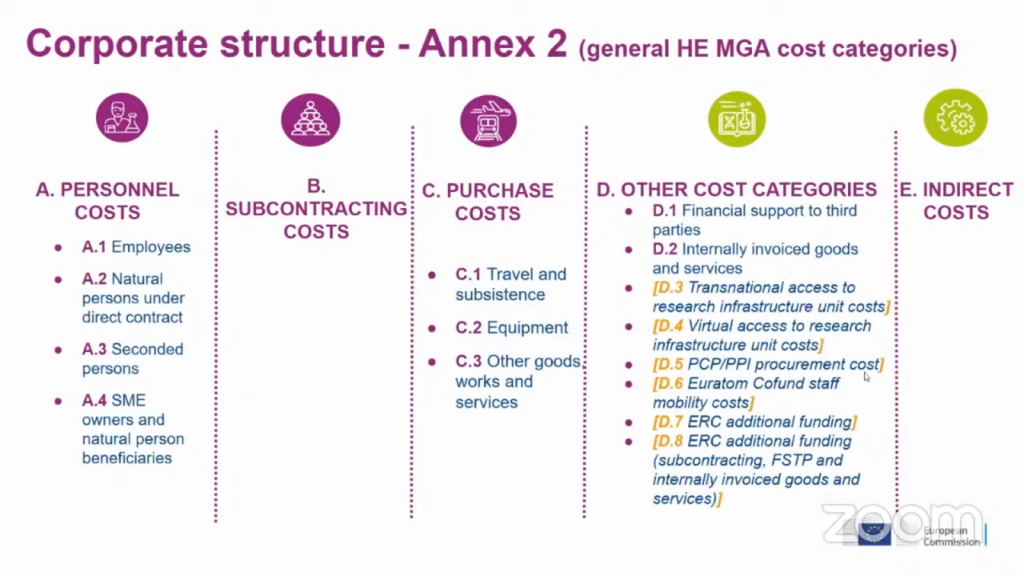

In Horizon Europe, whether a cost is eligible or ineligible depends on its nature and how it aligns with the programme’s financial rules. There are five main categories of eligible costs:

- Personnel Costs

- Subcontracting Costs

- Purchase Costs

- Other Direct Costs

- Indirect Costs

A comprehensive list of eligible costs is provided in Article 6.2 of the Annotated Model Grant Agreement (AMGA). You can also refer to this article or the chart below for further explanation.

Conditions for Cost Eligibility

For a cost to be considered eligible under Horizon Europe, it must meet all of the following criteria:

- Actual

- The cost must be real—not estimated, budgeted, or imputed.

- Incurred by the Beneficiary

- It must be incurred directly by the organisation that signed the Grant Agreement.

- Incurred During the Project Duration

- Only costs incurred during the action’s lifetime are eligible (with exceptions for costs related to final reports).

- Included in the Estimated Budget

- The cost must be listed in the project’s estimated budget within the Grant Agreement.

- Project-related Use

- It must be used solely to achieve the objectives and expected results of the funded project.

- Reasonable and Justified

- It must follow the principle of sound financial management, particularly in terms of economy and efficiency.

- Identifiable and Verifiable

- The cost must be:

- Properly recorded in the beneficiary’s accounts,

- In line with applicable national accounting standards and the organisation’s usual practices,

- Compliant with national laws on taxation, labour, and social security.

- The cost must be:

Overview of Eligible Cost Categories

- Personnel Costs: Salaries, social security contributions, and related staff costs.

- Subcontracting Costs: Services carried out by external entities.

- Purchase Costs: Equipment, goods, and services needed for the project.

- Other Direct Costs: Travel, dissemination, and other project-specific expenses.

- Indirect Costs: Flat-rate reimbursement to cover general overheads (25% of eligible direct costs, excluding subcontracting).

More detailed guidance is available in this article.

Ineligible Costs

The following costs cannot be charged to a Horizon Europe grant:

- Return on capital

- Debt and debt service charges

- Provisions for future losses or debts

- Interest owed

- Doubtful debts

- Currency exchange losses

- Bank charges

- Excessive or reckless expenditure

- Deductible VAT (note: non-deductible VAT is eligible)

- Costs incurred during the suspension of project implementation

- Costs already declared under another EU/Euratom grant (no double funding)

For full details and examples, always refer to the AMGA and the latest guidance from the European Commission.