Yes, you can declare the cost of an SME owner in Horizon Europe if she/he does not receive a salary. For this you need to determine the days worked on the Horizon Europe project and the daily rate of the SME owner.

The days worked on the Horizon Europe project by the SME owner has to be justified with a time-sheet. The daily rate is the monthly living allowance of 5.080€ / 18 days = 282,22€ multiplied by the country-specific correction coefficient of the country where the beneficiary is established.

In short: 5.080€ / 18 days * Country coefficient.

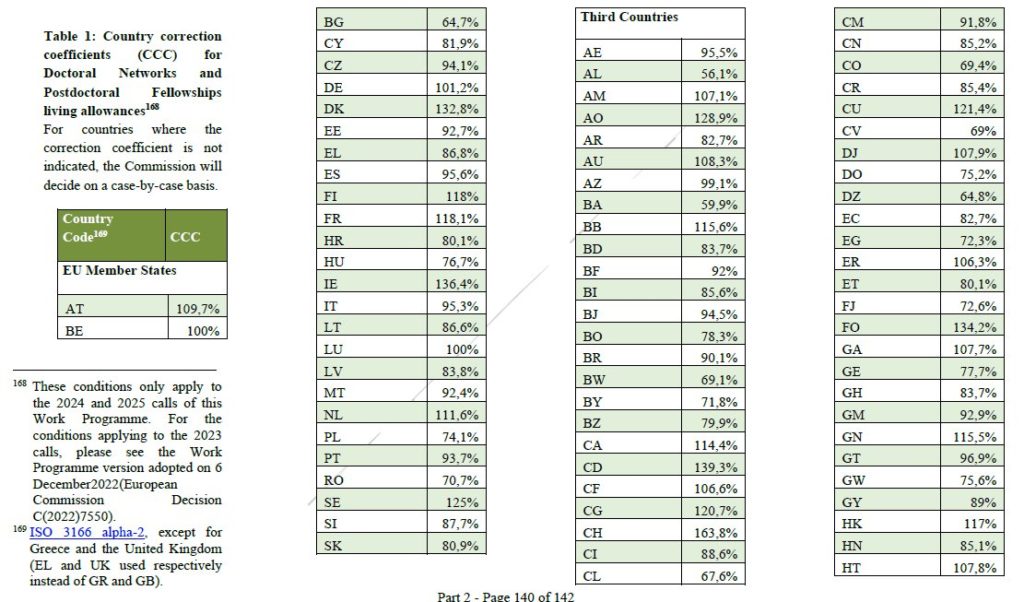

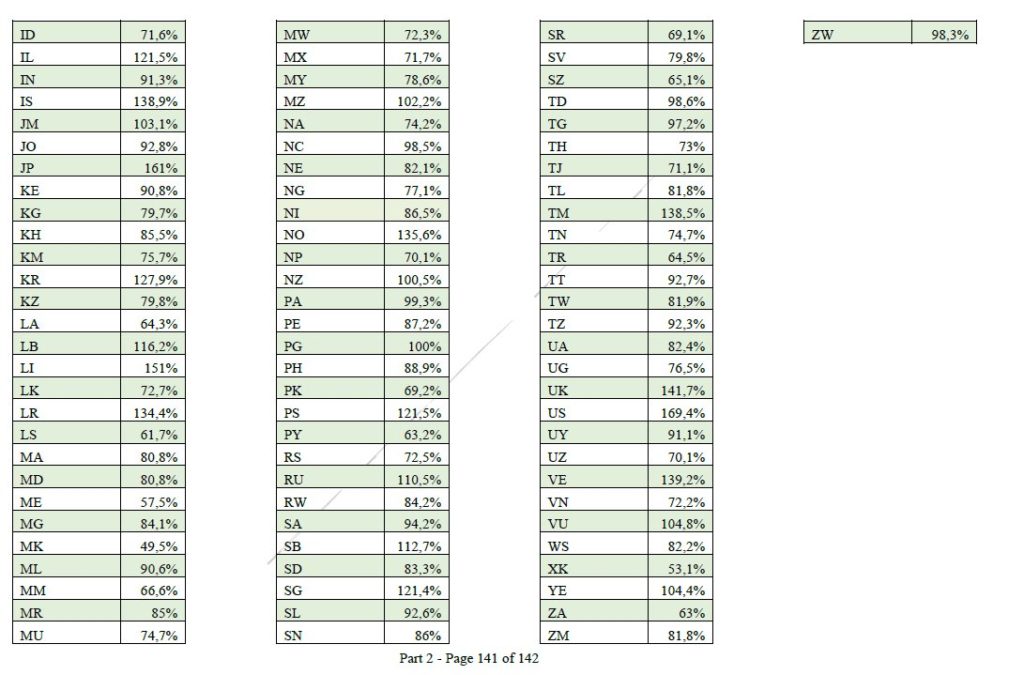

The country-specific correction coefficients are listed below:

Details can be found in the document Work Programme of Marie Skłodowska-Curie Actions available on the Funding & Tenders Portal in the Reference Documents section under HE Main Work Programme 2023-2024.

Below the extract from Annex 2a about the cost of SME owner in Horizon Europe:

ADDITIONAL INFORMATION ON UNIT COSTS AND CONTRIBUTIONS

SME owners/natural person beneficiaries without salary (Decision C(2020) 71151)

Type: unit costs

Units: days spent working on the action (rounded up or down to the nearest half-day)

Amount per unit (daily rate): calculated according to the following formula: {EUR 5 080 / 18 days = 282,22} multiplied by {country-specific correction coefficient of the country where the beneficiary is established}

The country-specific correction coefficients used are those set out in the Horizon Europe Work Programme (section Marie Skłodowska-Curie actions) in force at the time of the call (see Portal Reference Documents).