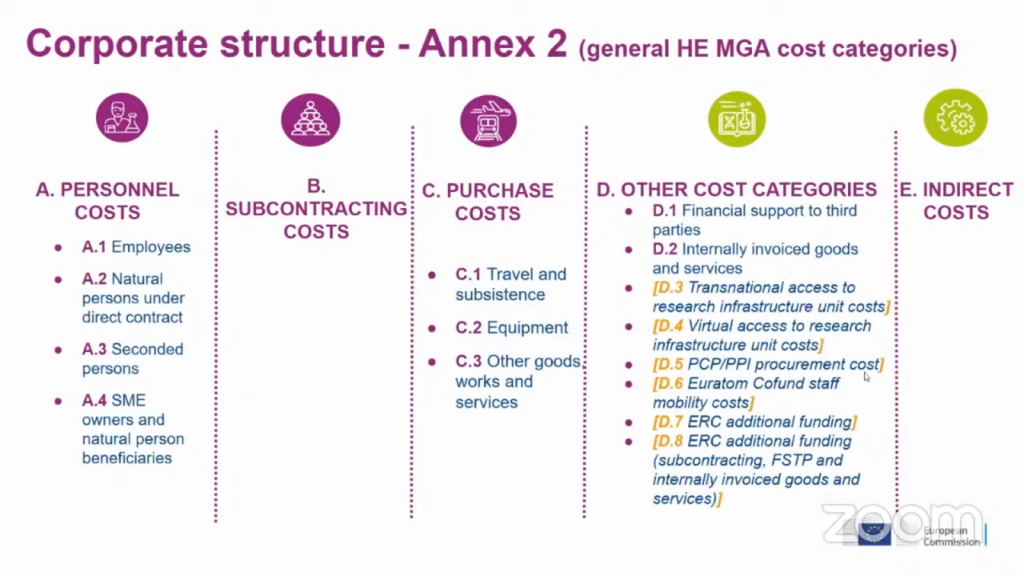

Costs can be eligible or ineligible in Horizon Europe depending on their nature. There are five eligible cost categories in Horizon Europe: Personnel, Subcontracting, Purchase, Other, and Indirect costs. The detailed list of eligible costs is available in the Annotated Model Grant Agreement AMGA Article 6.2 or in this article.

To be eligible, costs must respect certain conditions.

Eligible costs must be:

- Actual

- Actually incurred; not estimated, budgeted or imputed

- Incurred by the beneficiary

- Incurred during the duration of the project (exception: costs relating to last and final reports)

- Indicated in Grant Agreement estimated budget

- Used for the sole purpose of achieving the objectives of the project and its expected results

- Reasonable, justified

- Complying with the principle of sound financial management, in particular regarding economy and efficiency

- Identifiable and verifiable:

- Recorded in the accounts of the beneficiary

- In accordance with accounting standards applicable in the beneficiary’s establishment country and with the beneficiary’s usual cost accounting practices

- Complying with the applicable national law on taxes, labour and social security.

Below an overview of the eligible costs categories in Horizon Europe. More details can be found in this article.

Ineligible costs are:

- Costs related to return on capital

- Debt and debt service charges

- Provisions for future losses or debts

- Interest owed

- Doubtful debts

- Currency exchange losses

- Bank charges

- Excessive or reckless expenditure

- Deductible VAT (non deductible VAT is eligible)

- Costs incurred during suspension of the implementation of the action

- Costs declared under another EU/Euratom grant (no double funding)