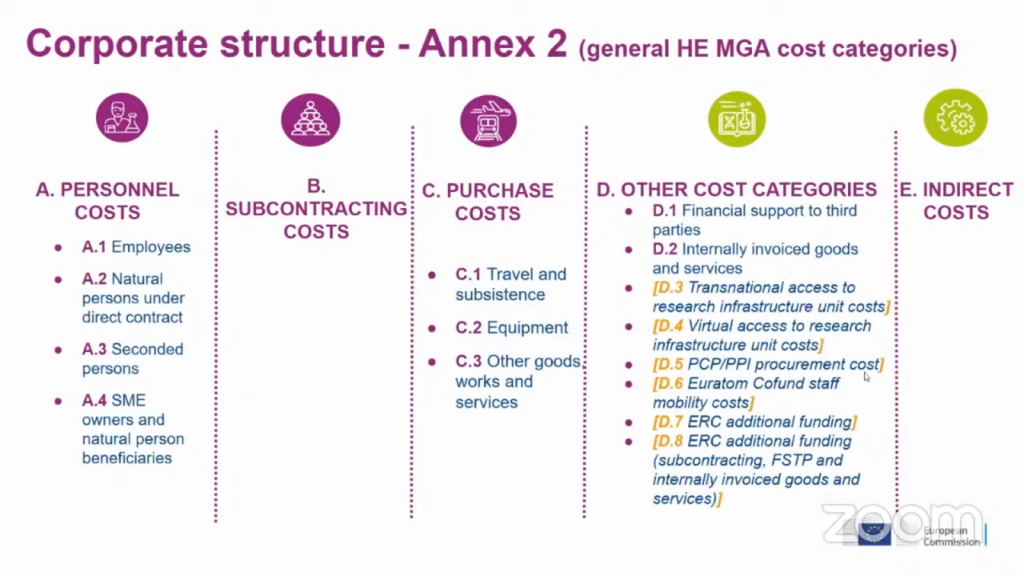

There are five eligible cost categories in Horizon Europe: personnel, subcontracting, purchase, other, and indirect costs. Below the complete list of costs eligible in Horizon Europe with extract from the General Model Grant Agreement GMGA Article 6.2 – Specific eligibility conditions for each budget category.

- A. Personnel costs:

- A.1 Costs for employees (or equivalent) are eligible as personnel costs if they fulfill the general eligibility conditions and are related to personnel working for the beneficiary under an employment contract (or equivalent appointing act) and assigned to the action. […]

- A.2 and A.3 Costs for natural persons working under a direct contract other than an employment contract and costs for seconded persons by a third party against payment are also eligible as personnel costs, if they are assigned to the action, fulfill the general eligibility conditions […]

- A.4 The work of SME owners for the action (i.e. owners of beneficiaries that are small and medium-sized enterprises not receiving a salary) or natural person beneficiaries (i.e. beneficiaries that are natural persons not receiving a salary) may be declared as personnel costs, if they fulfill the general eligibility conditions and are calculated as unit costs in accordance with the method set out in Annex 2a.

- B. Subcontracting costs

- Subcontracting costs for the action (including related duties, taxes and charges, such as non-deductible or non-refundable value added tax (VAT) are eligible, if they are calculated on the basis of the costs actually incurred, fulfill the general eligibility conditions and are awarded using the beneficiary’s usual purchasing practices — provided these ensure subcontracts with best value for money (or if appropriate the lowest price) and that there is no conflict of interests (see Article 12). […]

- C. Purchase costs

- Purchase costs for the action (including related duties, taxes and charges, such as non-deductible or non-refundable value added tax (VAT) are eligible if they fulfill the general eligibility conditions and are bought using the beneficiary’s usual purchasing practices — provided these ensure purchases with best value for money (or if appropriate the lowest price) and that there is no conflict of interests (see Article 12).

- Beneficiaries that are ‘contracting authorities/entities’ within the meaning of the EU Directives on public procurement must also comply with the applicable national law on public procurement.

- C.1 Travel and subsistence

- Purchases for travel, accommodation and subsistence must be calculated as follows:

- travel: on the basis of the costs actually incurred and in line with the beneficiary’s usual practices on travel

- accommodation: on the basis of the costs actually incurred and in line with the beneficiary’s usual practices on travel

- subsistence: on the basis of the costs actually incurred and in line with the beneficiary’s usual practices on travel.

- Purchases for travel, accommodation and subsistence must be calculated as follows:

- C.2 Equipment

- Purchases of equipment, infrastructure or other assets used for the action must be declared as depreciation costs, calculated on the basis of the costs actually incurred and written off in accordance with international accounting standards and the beneficiary’s usual accounting practices.

- Only the portion of the costs that corresponds to the rate of actual use for the action during the action duration can be taken into account.

- Costs for renting or leasing equipment, infrastructure or other assets are also eligible, if they do not exceed the depreciation costs of similar equipment, infrastructure or assets and do not include any financing fees. […]

- C.3 Other goods, works and services

- Purchases of other goods, works and services must be calculated on the basis of the costs actually incurred.

- Such goods, works and services include, for instance, consumables and supplies, promotion, dissemination, protection of results, translations, publications, certificates and financial guarantees, if required under the Agreement.

- D. Other cost categories

- D.1 Financial support to third parties

- Costs for providing financial support to third parties (in the form of grants, prizes or similar forms of support; if any) are eligible, if and as declared eligible in the call conditions, if they fulfill the general eligibility conditions, are calculated on the basis of the costs actually incurred and the support is implemented in accordance with the conditions set out in Annex 1. […]

- D.2 Internally invoiced goods and services

- Costs for internally invoiced goods and services directly used for the action may be declared as unit cost according to usual cost accounting practices, if and as declared eligible in the call conditions, if they fulfill the general eligibility conditions for such unit costs and the amount per unit is calculated… […]

- D.3 Transnational access to research infrastructure unit costs […]

- D.4 Virtual access to research infrastructure unit costs

- D.5 PCP/PPI procurement costs

- D.6 Euratom Cofund staff mobility costs

- D.7 ERC additional funding

- D.8 ERC additional funding (subcontracting, FSTP and internally invoiced goods and services)

- D.1 Financial support to third parties

- E. Indirect costs

- Indirect costs will be reimbursed at the flat-rate of 25% of the eligible direct costs (categories A-D, except volunteers costs, subcontracting costs, financial support to third parties and exempted specific cost categories, if any).

References:

GMGA Article 6.2 – Specific eligibility conditions for each budget category (Costs eligible in Horizon Europe)