Receipts in Horizon Europe means revenue. According to the Financial Regulation of the EU, receipts are limited to the Union grant and the revenue generated by the project. According to this regulation it is important to remember that non-profit organizations are not concerned by receipts. They are exempted of this aspect and do not need to deal with that.

In addition, according to the Horizon Europe General Model Grant Agreement, income generated by the exploitation of the results are not considered as receipts of the project. This is a continuity with Horizon 2020. Below references to the Horizon 2020 Annotated Model Grant Agreement (AMGA) as the AMGA of Horizon Europe is not published yet.

References:

Horizon Europe GMGA Article 22.3.4 Final payment — Final grant amount — Revenues and Profit — Recovery

‘Revenue’ is all income generated by the action, during its duration (see Article 4), for beneficiaries that are profit legal entities [OPTION if selected for the call: (— with the exception of income generated by the exploitation of results, which are not considered as revenues)].

Annotated Model Grant Agreement: Article 21 – Payments and payment arrangements

Payment of the balance – Calculation of receipts & deduction of profit (no-profit rule)

From this amount, the Commission/Agency will deduct any profit made due to receipts. Thus, the total accepted EU contribution + receipts are capped at the total accepted costs; the amount resulting from Steps 1 and 2 plus receipts cannot exceed the accepted costs.

If grant amount + receipts > total accepted costs –> deduction of profit

Profit is assessed at the level of the action, NOT at the level of the individual beneficiaries.

The receipts that must be taken into account are receipts which have been, during the action duration (see Article 3):

- established (i.e. revenue that has been collected AND entered in the accounts)

- generated (i.e. revenue that has not yet been collected, but which has been generated) or

- confirmed (i.e. revenue that has not yet been collected, but for which the beneficiary has a commitment or written confirmation).

The following are considered receipts:

- income generated by the action (i.e. any income generated by the action itself, including the sale of assets bought for the action and sold during the action duration)

- Examples: admission fee to a conference organised by the consortium; sale of equipment bought for the action.

- Receipts from the sale of assets are capped at the amount of costs declared for the asset.

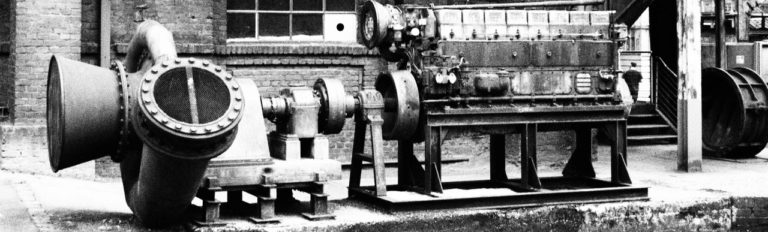

- Example: Machine bought for EUR 21 000 in year X, sold in year X + 4 (both within the action duration) for EUR 16 000. The machine was used at 50% for the action, and fully depreciated in 3 years (7 000 EUR/year, of which 3 500 EUR/year were charged to the action) Amount of receipts to be declared: 50% of 16 000 with a limit of 10 500 (3 x 3 500) = EUR 8 000

- financial contributions given by third parties specifically to be used for the action (i.e. money given as a donation by a third party (a donor) to a beneficiary/linked third party specifically for being used for the action)

- in-kind contributions provided by third parties free of charge specifically to be used for the action, if they have been declared as eligible costs (i.e. not money, but an in-kind contribution free of charge given by a third party (a donor) specifically for being used for the action)

- Examples: the free use of equipment; the secondment of an expert without reimbursement

Receipts due to free of charge in-kind contributions are capped by the amount declared as third party costs for the contribution.

The following are NOT considered receipts:

- in-kind contributions given by a third party (donor) free of charge — if they were not given specifically to be used for the action

- Example: A university professor whose costs are charged by the beneficiary university in the GA, but whose salary is paid by the ministry and not reimbursed by the university: This in-kind contribution from a third party (the ministry) is not to be considered a receipt, unless the professor has been specifically seconded by the ministry to the university to work for the action in question. In other words, if the university is free to decide the allocation of the professor’s work, then his/her contribution is assimilated to an ‘own resource’ of the university and it is not a receipt.

- financial contributions given by a third party (donor) specifically to be used for the action — if they may be used according to the donor’s rules to cover also costs other than the eligible costs

- Example: currency exchange losses

- financial contributions given by a third party (donor) specifically to be used for the action — if the donor did not set the obligation to repay any unused amount at the end of the action. In this case, the full amount of the financial contribution is considered not a receipt (not only the unused amount).

- financial contributions made by one beneficiary to another within the same action — since receipts are only contributions from third parties. Conversely, such a financial contribution cannot either be declared as cost for the action.

- Example: Beneficiary A (big company) in an innovation project (i.e. funded at 70%) decides to subsidise a small specialised SME by funding an additional 10% of the SME’s costs in order to encourage it to participate in the action.

- income generated by exploiting the results of the project (e.g. the IPR) — since successfully exploiting the results is one of the main objectives of the action

Receipts will be taken into account by the Commission/Agency only at the moment of the payment of the balance (i.e. the final payment at the end of the action). They must be declared in the final report. In many cases they will not affect the grant amount since they do not lead to a profit (at the level of the action). However, particularly in actions funded at 100%, they may have an impact and cause a reduction. Examples:

- Eligible costs: 100 and grant amount: 70

- If receipts: 30 –> no impact

- If receipts: 20 –> no impact

- If receipts: 60 –> the grant amount will be reduced to 40.

- Eligible costs: 100 and grant amount: 100

- If receipts: 0 –> no impact;

- If receipts: 20 –> the grant amount will be reduced to 80

- Best practice: The potential implications of receipts should be addressed in the consortium agreement (see Article 41.3).

Financial Regulation applicable to the general budget of the Union

Article 192 – No-profit principle

Grants shall not have the purpose or effect of producing a profit within the framework of the action or the work programme of the beneficiary (‘no-profit principle’).

For the purposes of paragraph 1, a profit shall be defined as a surplus, calculated at the payment of the balance, of receipts over the eligible costs of the action or work programme, where receipts are limited to the Union grant and the revenue generated by that action or work programme.

In the case of an operating grant, amounts dedicated to the building up of reserves shall not be taken into account for verifying compliance with the no-profit principle.

Paragraph 1 shall not apply to:

- (a) actions the objective of which is the reinforcement of the financial capacity of a beneficiary, or actions which generate income to ensure their continuity after the period of Union financing provided for in the grant agreement;

- (b) study, research, training or education support paid to natural persons or other direct support paid to natural persons most in need, such as unemployed persons and refugees;

- (c) actions implemented by non-profit organisations;

- (d) grants in the form referred to in point (a) of the first subparagraph of Article 125(1);

- (e) low value grants.