External experts in Horizon Europe are usually justified as other goods, works and services. However, this can depend on the type of contract your entity makes with the supplier. Therefore, external experts in Horizon Europe can be justified under three types of categories. Usually this goes under other goods. works and services (C3) as this is a purchase of a service for a defined cost. But other entities can declare this cost under personnel (A2) natural person if case it is a consultant.However, the contract with the supplier has to fulfill precise conditions: work under conditions similar to those of an employee in particular regarding the way the work is organised, the tasks that are performed and the premises where they are performed, and the result of the work belongs to the beneficiary. Finally, it can be also put under (B) subcontracting in case an entire task is being subcontracted to the external expert. The advantage here is that the hourly rate of the external expert can be higher than in the case of A2 natural person.

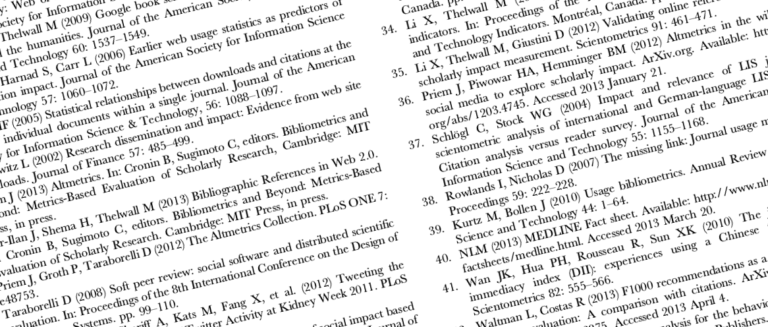

References:

GMGA Article 6.2 – A Personnel costs

A.2 and A.3 Costs for natural persons working under a direct contract other than an employment contract and costs for seconded persons by a third party against payment are also eligible as personnel costs, if they are assigned to the action, fulfil the general eligibility conditions and (a) work under conditions similar to those of an employee (in particular regarding the way the work is organised, the tasks that are performed and the premises where they are performed) and (b) the result of the work belongs to the beneficiary (unless agreed otherwise).

GMGA Article 6.2 – C.3 Other goods, works and services

Purchases of other goods, works and services must be calculated on the basis of the costs actually incurred. Such goods, works and services include, for instance, consumables and supplies, promotion, dissemination, protection of results, translations, publications, certificates and financial guarantees, if required under the Agreement.

GMGA Article 6.2 – B. Subcontracting costs

Subcontracting costs for the action (including related duties, taxes and charges are eligible, if they are calculated on the basis of the costs actually incurred, fulfil the general eligibility conditions and are awarded using the beneficiary’s usual purchasing practices — provided these ensure subcontracts with best value for money (or if appropriate the lowest price) and that there is no conflict of interests (see Article 12). Beneficiaries that are ‘contracting authorities/entities’ within the meaning of the EU Directives on public procurement must also comply with the applicable national law on public procurement