How to calculate personnel costs in Horizon Europe is the most important change compared to Horizon 2020.

This excel template with fictitious numbers might be of great help.

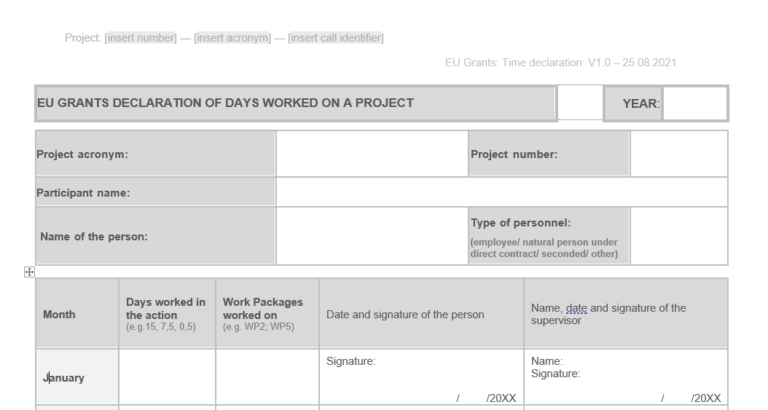

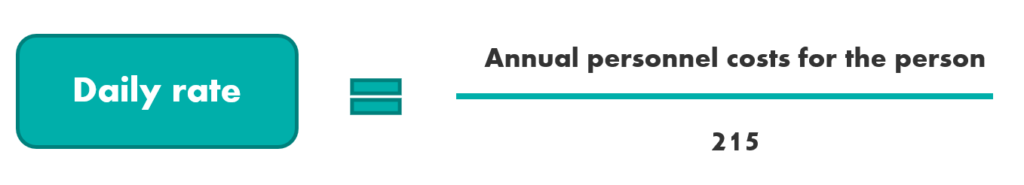

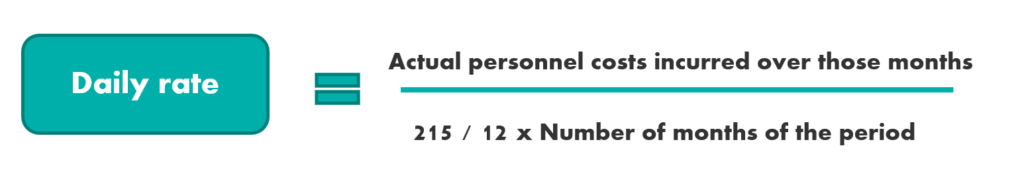

First, you have to calculate the daily rate of the person working on the project. This is done by taking the annual personnel costs for the person and divide it by 215. The annual personnel costs must be limited to salaries, social security contributions, taxes, and must be calculated on costs actually incurred. Then, this amount needs to be divided by 215, which is fixed and cannot be changed. Why 215? Because we take the 1720 fixed hours from Horizon 2020 and divide it by 8h worked per day. This gives us 215.

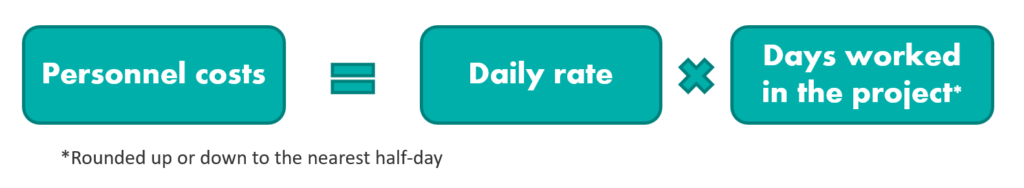

Then, once we have the daily rate, we multiply it by the days worked on the project and we get the personnel costs. The days worked in the project have to be rounded up or down to the nearest half.

In case the reporting period is shorter than a year (12 months), we have to do a pro-rata.

Calculate Personnel Costs Horizon Europe Example 1: Full year

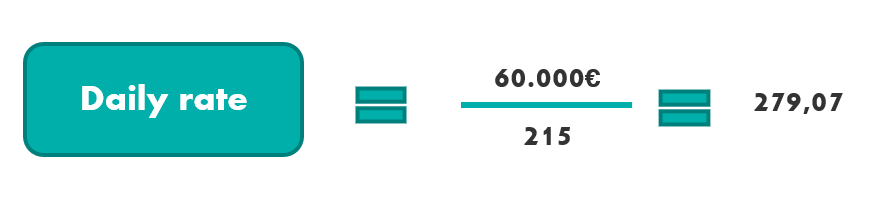

The daily rate calculation is made on a calendar year basis, going from January until December, which is easy to do for a full year as we have the total annual cost incurred. Imagine we are in January 2022 and we have to report personnel costs incurred in 2021 of James Brown, an employee that worked on a Horizon Europe project in 2021 during 140 days in total. He also did other tasks than only this project. He did not work full time on the project, only 160 days over the entire year. His total annual personnel costs is of 60.000€.

First, we calculate his daily rate. For this we divide the actual personnel costs incurred in 2021 of 60.000€ by 215. We get 279,07.

To get his personnel costs for the project, we now multiply this daily rate by the number of days worked on the project. In this case 160, and we get the eligible personnel costs, 44.651,16€.

Calculate Personnel Costs Horizon Europe Example 2: Partial year

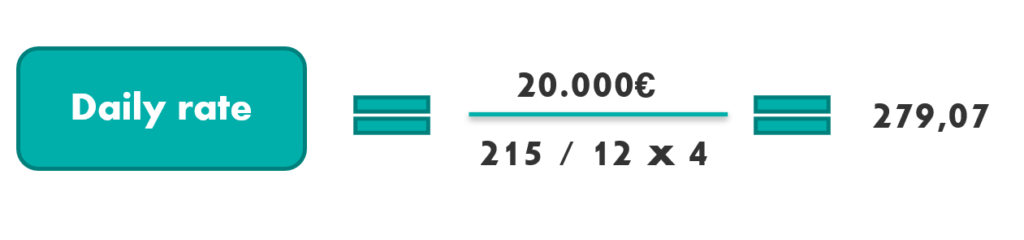

In the case the reporting period ends before 31.12 and you don’t have the actual annual personnel cost, it is slightly more complicated as we have to do a pro-rata. Imagine we are in June 2021 and we have to report the personnel costs of Patricia Williams that incurred in the period from January to April 2021. Patricia Williams also has an annual personnel cost of 60.000€ and during these four months she only worked 55 days on the Horizon Europe project.

In this case, the total annual costs did not incur yet. Therefore, we only take into account the costs incurred over those four months, being 20.000€. To calculate the daily rate, we divide the 20.000€ by 215, divided by 12 multiplied by 4 and we get 232,56. Then, to get the personnel costs for the period, we multiply the daily rate by the number of days worked, 65, and we get 15.348,85€.

References:

Webinar of the European Commission: How to prepare a successful proposal in Horizon Europe (24 March 2021)

GMGA Article 6.2 Specific eligibility conditions for each budget category

Direct costs – A. Personnel costs – A.1 Costs for employees (or equivalent)

A.1 Costs for employees (or equivalent) are eligible as personnel costs if they fulfill the general eligibility conditions and are related to personnel working for the beneficiary under an employment contract (or equivalent appointing act) and assigned to the action. They must be limited to salaries (including net payments during parental leave), social security contributions, taxes and other costs linked to the remuneration, if they arise from national law or the employment contract (or equivalent appointing act) and be calculated on the basis of the costs actually incurred, in accordance with the following method:

- {daily rate for the person} multiplied by {number of day-equivalents worked on the action (rounded up or down to the nearest half-day)}

The daily rate must be calculated as:

- {annual personnel costs for the person} divided by {215}

The number of day-equivalents declared for a person must be identifiable and verifiable (see Article 20).

The actual time spent on parental leave by a person assigned to the action may be deducted from the 215 days indicated in the above formula.

The total number of day-equivalents declared in EU grants, for a person for a year, cannot be higher than 215 minus time spent on parental leave (if any).

For personnel which receives supplementary payments for work in projects (project-based remuneration), the personnel costs must be calculated at a rate which:

- corresponds to the actual remuneration costs paid by the beneficiary for the time worked by the person in the action over the reporting period

- does not exceed the remuneration costs paid by the beneficiary for work in similar projects funded by national schemes (‘national projects reference’)

- is defined based on objective criteria allowing to determine the amount to which the person is entitled, and

- reflects the usual practice of the beneficiary to pay consistently bonuses or supplementary payments for work in projects funded by national schemes.

The national projects reference is the remuneration defined in national law, collective labour agreement or written internal rules of the beneficiary applicable to work in projects funded by national schemes.

If there is no such national law, collective labour agreement or written internal rules or if the project-based remuneration is not based on objective criteria, the national project reference will be the average remuneration of the person in the last full calendar year covered by the reporting period, excluding remuneration paid for work in EU actions.

If the beneficiary uses average personnel costs (unit cost according to usual cost accounting practices), the personnel costs must fulfil the general eligibility conditions for such unit costs and the daily rate must be calculated:

- using the actual personnel costs recorded in the beneficiary’s accounts and excluding any costs which are ineligible or already included in other budget categories; the actual personnel costs may be adjusted on the basis of budgeted or estimated elements, if they are relevant for calculating the personnel costs, reasonable and correspond to objective and verifiable information, and

- according to usual cost accounting practices which are applied in a consistent manner, based on objective criteria, regardless of the source of funding.