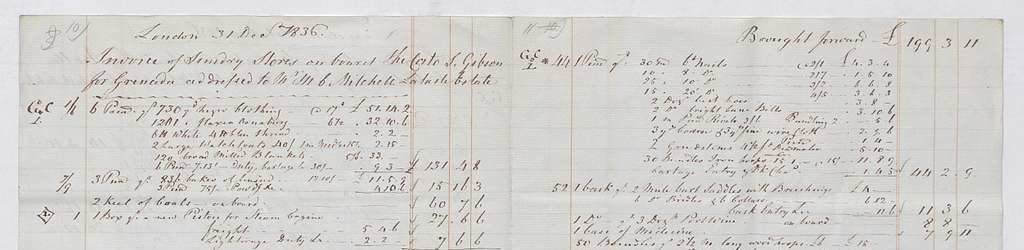

Yes, internal invoices are eligible in Horizon Europe. Officially known as internally invoiced goods and services, they correspond to the category D.2, according to article 6.2 of the General Model Grant Agreement (GMGA) of Horizon Europe. These are goods and services that are produced and invoiced internally, within your organization. As in Horizon 2020, internal invoices are eligible in Horizon Europe. But, with Horizon Europe, there is a wider reliance on the beneficiary’s usual cost accounting practices for the unit cost calculation and the possibility to accept actual indirect costs, that could be higher than 25%. This needs to be done on the basis of usual accounting practices.

Internally invoiced goods and services are happening in large organizations for self-produced consumables, when using special facilities or devices. For example for the production of chemicals, the use of an animal house, or a clean room, wind tunnel, etc.

References:

AMGA Article 6.2 – D.2 Internally invoiced goods and services

Costs for internally invoiced goods and services directly used for the action may be declared as unit cost according to usual cost accounting practices, if and as declared eligible in the call conditions, if they fulfill the general eligibility conditions for such unit costs and the amount per unit is calculated:

- using the actual costs for the good or service recorded in the beneficiary’s accounts, attributed either by direct measurement or on the basis of cost drivers, and excluding any cost which are ineligible or already included in other budget categories; the actual costs may be adjusted on the basis of budgeted or estimated elements, if they are relevant for calculating the costs, reasonable and correspond to objective and verifiable information and

- according to usual cost accounting practices which are applied in a consistent manner, based on objective criteria, regardless of the source of funding.

‘Internally invoiced goods and services’ means goods or services which are provided within the beneficiary’s organization directly for the action and which the beneficiary values on the basis of its usual cost accounting practices.

This cost will not be taken into account for the indirect cost flat-rate.