Sick leaves in Horizon Europe are eligible if they are an actual cost for your entity. According to the Annotated Model Grant Agreement, you may not include any part of the remuneration which has not been an actual cost for you (for example, salaries reimbursed by a social security scheme or a private insurance in case of long sick leave). Therefore, if your entity did not pay the long-term sick leaves, you cannot include it in the calculation.

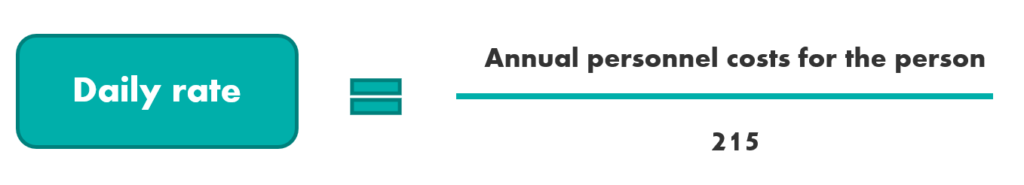

To calculate the daily rate, take the actual personnel costs incurred during the year (if sick leave paid by social security, do not include it), divide it by 215.

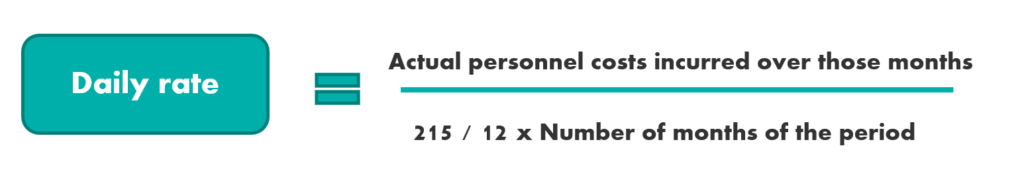

If the person was not working during the entire project duration, divided the daily rate by 12 multiplied by the number of months of the period.

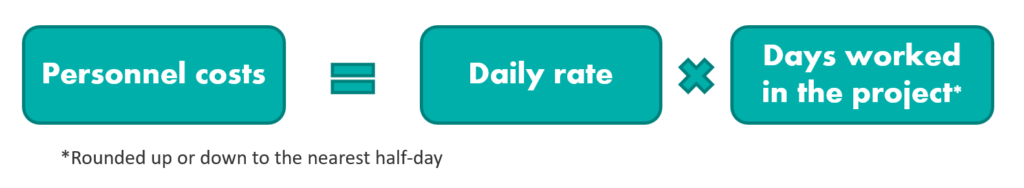

Then, multiply it by the number of days worked on the project to get the eligible personnel cost.

You cannot deduct any leaves or absences from the 215 days, including long-term sick leave, breastfeeding leave and leave to take care of a sick child. Only days on maternity/paternity leave during the calendar year may be deducted from the 215 days.

Therefore, sick leaves are eligible in Horizon Europe under certain conditions.

For more information about personnel cost calculation in Horizon Europe, check this article.