Subcontracting is for an entire defined task whereas other goods and services is for a specific good or service. If the service that you are contracting is related to the realization of the task, it falls under subcontracting category cost. If the services contracted is just a support for the realization of the task, then it falls under other goods and services. This rules prevails for Horizon Europe and Horizon 2020.

To better understand the difference between subcontracting and other goods and services cost categories, here is an example: if you buy a communication campaign form an agency, this will be subcontracting. If you buy only a website from the agency, this will be other goods and services.

About subcontracting:

Subcontracting means that a defined task is not carried out by the beneficiary but is outsourced to an external third party. A subcontractor is called upon by a beneficiary to implement an action task and issues an invoice for the service provided (work or service, delivery of goods) at regular market prices. No indirect costs for the beneficiary are added to subcontracting costs, meaning that you cannot add the 25% indirect costs.

Subcontracting can only cover a limited part of the project and must be awarded following to “best value for money” principle. No core deliverable, milestone nor task can be assigned to a subcontractor. The entity that subcontracts will be wholly responsible for the delivery and behavior of the subcontracting party.

Subcontracting has an appropriate budget allocated in the Grant Agreement. If this is not the case the beneficiary bears the risk of ex-post recognition of costs by the funding agency.

About other goods, works, and services:

Costs for other goods, works, and services are contracts for the delivery of goods or services, but are not entire project tasks. Such goods, works and services include, for instance, consumables and supplies, promotion, dissemination, protection of results, translations, publications, certificates and financial guarantees, if required under the Grant Agreement. Other goods, works, and services have to be taken into consideration when calculation the 25% indirect costs.

References

Annotated Model Grant Agreement of Horizon Europe (AMGA) Article 6.2 – B. Subcontracting costs

Subcontracting costs for the action (including related duties, taxes and charges, such as non-deductible or non-refundable value added tax (VAT)) are eligible, if they are calculated on the basis of the costs actually incurred, fulfill the general eligibility conditions and are awarded using the beneficiary’s usual purchasing practices — provided these ensure subcontracts with best value for money (or if appropriate the lowest price) and that there is no conflict of interests (see Article 12).

Beneficiaries that are ‘contracting authorities/entities’ within the meaning of the EU Directives on public procurement must also comply with the applicable national law on public procurement.

The beneficiaries must ensure that the subcontracted work is performed in the eligible countries or target countries set out in the call conditions — unless otherwise approved by the granting authority.

Subcontracting may cover only a limited part of the action.

The tasks to be subcontracted and the estimated cost for each subcontract must be set out in Annex 1 and the total estimated costs of subcontracting per beneficiary must be set out in Annex 2 (or may be approved ex post in the periodic report, if the use of subcontracting does not entail changes to the Agreement which would call into question the decision awarding the grant or breach the principle of equal treatment of applicants; ‘simplified approval procedure’).

AMGA Article 6.2 – C.3 Other goods, works and services

Purchases of other goods, works and services must be calculated on the basis of the costs actually incurred. Such goods, works and services include, for instance, consumables and supplies, promotion, dissemination, protection of results, translations, publications, certificates and financial guarantees, if required under the Agreement.

AMGA Article 7 – Beneficiaries

The coordinator may not delegate or subcontract the above-mentioned tasks to any other beneficiary or third party (including affiliated entities).

However, coordinators which are public bodies may delegate the tasks set out in Point (b)(ii) last indent and (iii) above to entities with ‘authorisation to administer’ which they have created or which are controlled by or affiliated to them. In this case, the coordinator retains sole responsibility for the payments and for compliance with the obligations under the Agreement.

Moreover, coordinators which are ‘sole beneficiaries’31 (or similar, such as European research infrastructure consortia (ERICs)) may delegate the tasks set out in Point (b)(i) to (iii) above to one of their members. The coordinator retains sole responsibility for compliance with the obligations under the Agreement.

Suppliers of goods, works or services and third parties providing in-kind contributions (against payment or free of charge) do not implement action tasks themselves, but only make resources available to the beneficiary, whereas subcontractors, linked third parties and international partners implement action tasks.

Third parties involved in the action do not sign the GA.

The differences between subcontracts (Article 13) and other contracts for purchase of goods, works or services (Article 10) are:

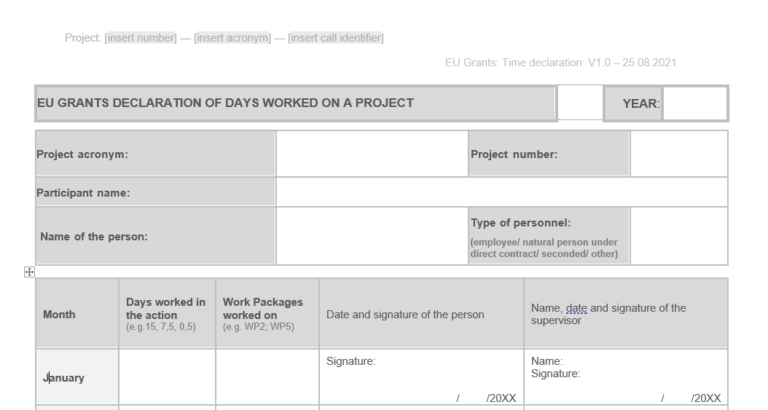

| Article 10 Contracts to purchase goods, works or services | Article 13 Subcontracts |

| These contracts do not cover the implementation of action tasks, but they are necessary to implement action tasks by beneficiaries. | Subcontracts concern the implementation of action tasks; they imply the implementation of specific tasks which are part of the action and are described in Annex 1. |

| Does not have to be indicated in Annex 1. | Must be indicated in Annex 1. |

| The price for these contracts will be declared as ‘other direct costs’ — column D in Annex 2 — in the financial statement; they will be taken into account for the application of the flat-rate for indirect costs. | The price for the subcontracts will be declared as ‘direct costs of subcontracting’ — column B in Annex 2 — in the financial statement; they will not be taken into account for the application of the flat-rate for indirect costs. |

Example (contracts): Contract for a computer; contract for an audit certificate on the financial statements; contract for the translation of documents; contract for the publication of brochures; contract for the creation of a website that enables action’s beneficiaries to work together (if creating the website is not an action task); contract for organisation of the rooms and catering for a meeting (if the organisation of the meeting is not an action task mentioned as such in Annex 1); contract for hiring IPR consultants/agents.

Example (subcontracts): Contract for (parts of) the research or innovation tasks mentioned in Annex 1.