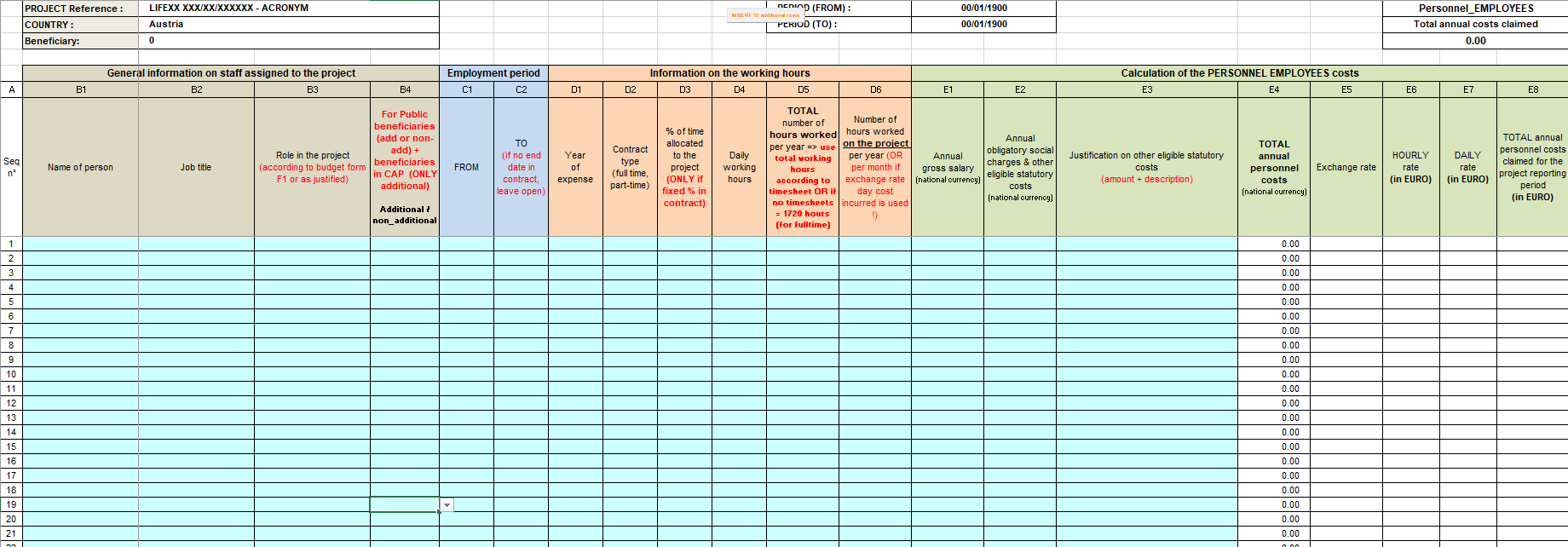

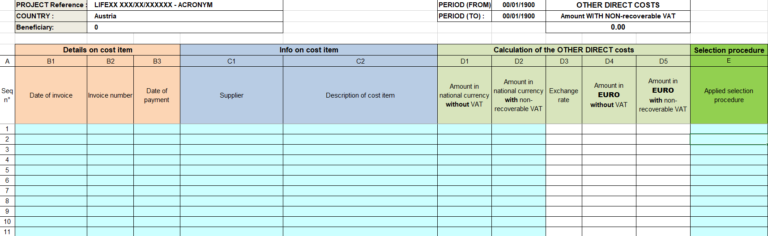

When reporting personnel costs in a Life Project, you have to use the templates provided by the European Commission.

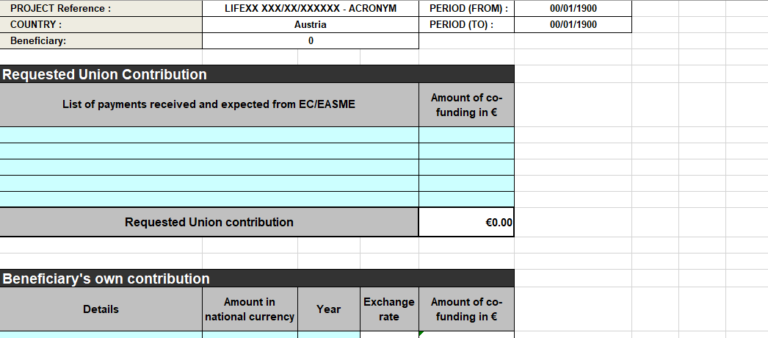

For the coordinator, the consolidated financial statement template is available here and the guidelines for the coordinating beneficiary is available here (links from the CINEA website).

For the individual beneficiaries, the following financial statement template (link) needs to be used.

When to encode personnel costs under the ‘personnel_employees’ sheet or ‘personnel_non-employees’ sheet?

For employees, the salary costs per year are to be included in the ‘personnel_employees’ sheet – separated between the gross annual salary of the employee and the annual obligatory social charges/other eligible statutory costs. For non-employees (paid on the basis of an invoice with/without VAT) the hourly/daily rates as mentioned in their contract should be included in the ‘personnel_non-employees’ sheet – once with and once without VAT.

How to encode the personnel costs of employees that work based on a fixed percentage and for which the exchange rate option of the date that the cost was incurred is used?

The total yearly salary cost in national currency should be divided by 1720 to get the hourly rate in national currency, then the rate is re-calculated to the EUR hourly rate with the monthly exchange rate (but we have one hourly rate in national currency per year). The total hours charged per month should then be calculated in line with the percentage ‘X’ that the employee works in the LIFE project in accordance with his/her employment contract, i.e. 1720/12 *X%