To report personnel costs in Horizon 2020 is not necessarily a simple thing. Personnel costs is the cost of the time worked for the Horizon 2020 project by employees, seconded staff, SME owners, and consultants.

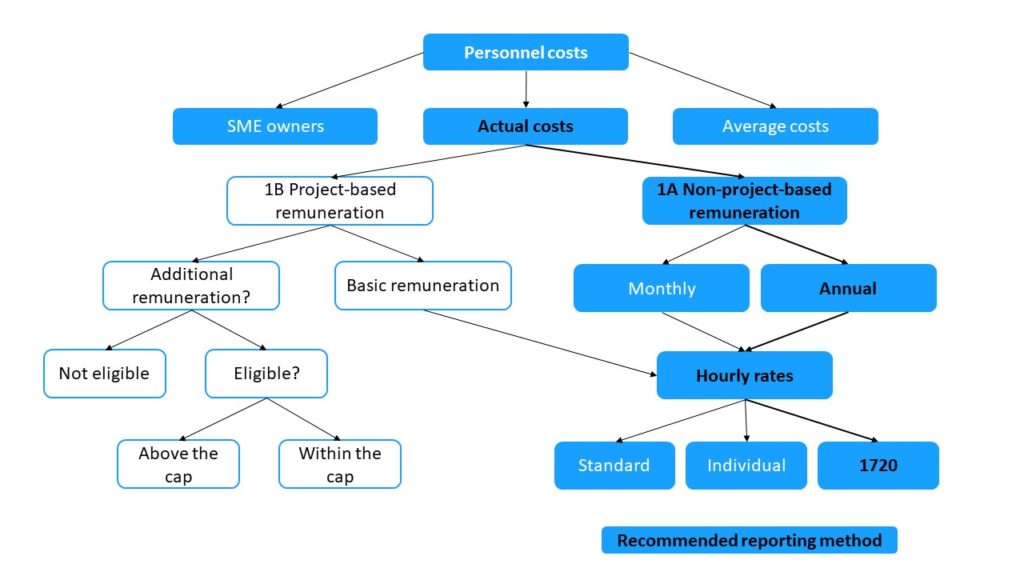

There are different manners to report personnel costs in Horizon 2020:

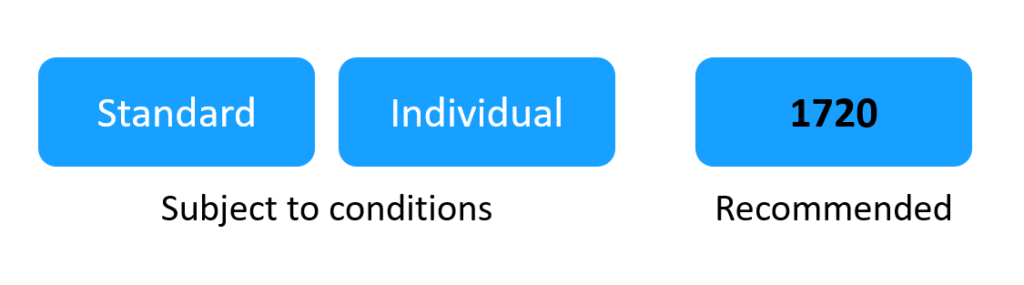

As shown in the diagram above, there are many ways to report personnel costs and it is not necessarily easy to find its way. The European Commission recommends to go for the 1720 annual hours method, that strongly simplifies the reporting.

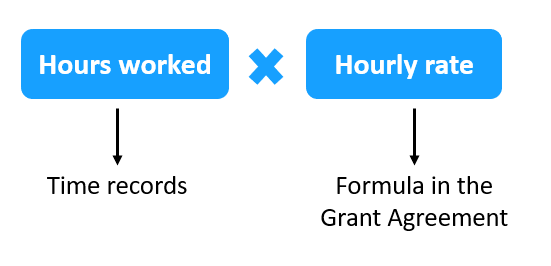

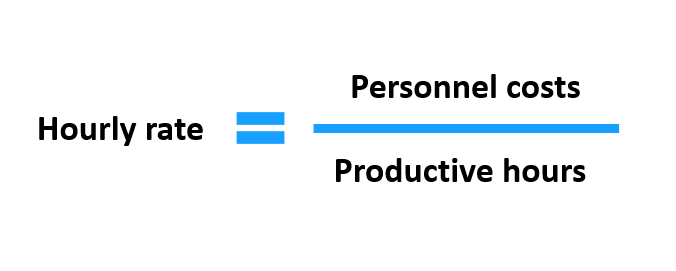

Once the method chosen, the principle for calculating the personnel cost is simple: multiply the hours worked by the hourly rate.

You can only declare hours really worked on the project. You cannot declare budgeted time (what is in the budget9, estimated time (guessing), nor time allocation (% of the time of the person). You must record in time-sheets the time the person worked on the project.

How to calculate the hourly rate?

Personnel costs are the real salary, social security contributions, taxes and other costs included in the remuneration that arises from national law or the employment contract.

There are three different methods to calculate the productive hours:

The European Commission recommends the 1720 annual productive hours model as it simplifies the cost reporting.

The only concept that can be removed from 1720 annual productive hours is the parental leave.

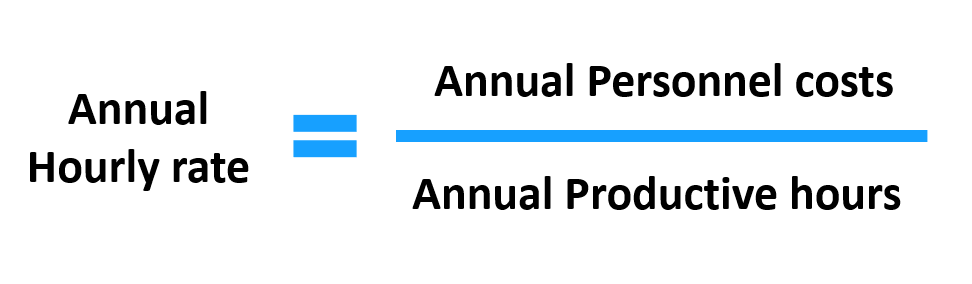

The hourly rate can is generally calculated on an annual basis.

For the months running from the end of the last financial year until the end of the reporting period you must use the hourly rate of the last financial year.

Double ceiling

You must ensure that the total number of hours declared in EU grants for a person for a year is not higher than the number of annual productive hours used for the calculation of the hourly rate.

You must ensure that the total amount of personnel costs declared (for reimbursement as actual costs) in EU grants for a person is not higher than the total personnel costs recorded in the beneficiary’s accounts (for that person for that year).

For more information, please refer to the webinar of the European Commission from the 15th of June 2021 available here.