Correct currency conversion is essential when reporting costs in EU-funded projects such as Horizon Europe. Using the wrong exchange rate or method can lead to rejected costs, audit findings, or financial corrections. This guide explains how to properly convert currencies into euros or into your local currency, following EU rules and best accounting practices.

Why Currency Conversion Matters in EU Funding

EU project budgets and financial reports must be accurate, transparent, and verifiable. Since costs may be incurred in multiple currencies, beneficiaries must apply approved exchange rates and consistent accounting methods.

Failing to follow these rules can result in:

- Ineligible cost declarations

- Payment delays

- Audit risks

- Grant reductions

Converting Local Currency into Euros (EUR)

When reporting costs in euros, use the following rules:

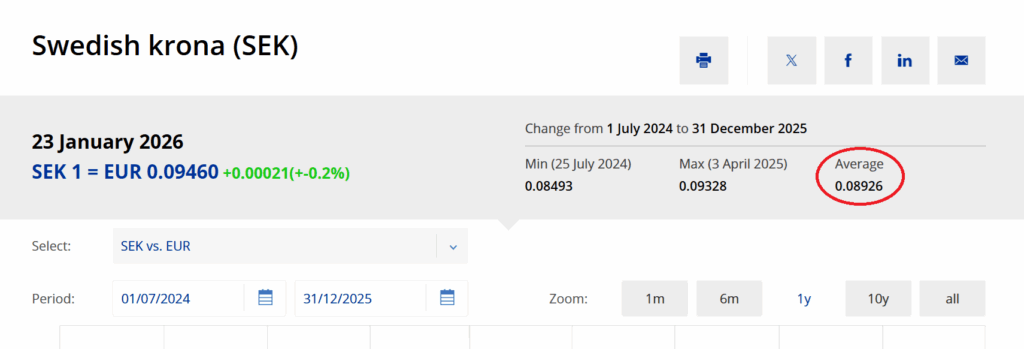

✅ Use the European Central Bank (ECB) yearly average exchange rate

- Apply the ECB’s official reporting period average rate for converting your local currency into EUR.

- Define start and end date of your reporting period

- Take the average exchange rate of your local currency vs. EUR

✅ If your currency is not listed by the ECB, use InforEuro

- InforEuro is the European Commission’s official exchange rate tool.

- It provides approved rates for currencies not covered by the ECB.

Converting Other Currencies into Your Local Currency

If you incur costs in a foreign currency and need to convert them into your local currency, follow this rule:

✅ Apply your organisation’s usual accounting practices

- Use the same method your organisation applies in normal financial operations.

- Ensure the method is:

- Consistent

- Documented

- Auditable

Examples of acceptable practices

- Internal monthly average exchange rates

- ERP or accounting system default conversion rules

- Approved finance department procedures

Key requirement

Be consistent across the entire project and maintain documentation for audit purposes.

Best Practices for Audit Compliance

To stay compliant:

- Keep original invoices in the original currency

- Keep exchange rate sources (ECB or InforEuro)

- Document conversion calculations

- Apply the same method throughout the project

- Ensure your finance team and project managers follow the same rules

Final Tip for EU Project Beneficiaries

Currency conversion may seem like a minor technical detail, but it is a common audit focus area in EU-funded projects. Setting up a clear internal policy early can save time, prevent errors, and protect your funding.